In the first post in this attrition series, Is Saving Customers Important?, we discussed why customer retention is vital to your company’s growth and its future.

Just like plugging the leaks in a bucket is essential to keeping the water level in the bucket high and growing.

Now let’s look more closely at how attrition is defined and measured.

The Monitoring Association (TMA), formerly the Central Station Alarm Association, is an internationally-recognized, non-profit trade association representing professional monitoring companies.

For the last 15 years or more it has been accumulating attrition results from a substantial number of security alarm companies from the largest publicly held companies down to small companies. It reports these results annually and the latest report covers 2015 and prior years.

We will use their reports as the source for the attrition statistics for the industry.

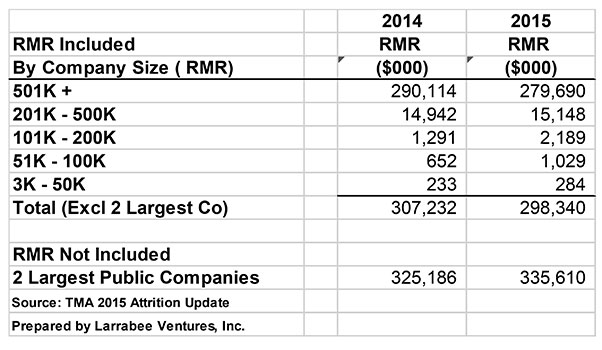

The data used by TMA includes approximately $300 million in RMR, many millions of accounts, and it excludes the 2 largest public companies. Here are the sources of recurring monthly revenue (RMR) included in the analysis by company size:

Attrition Defined

The Monitoring Association’s Attrition Project defines gross and net attrition as follows:

- GROSS ATTRITION:

The loss of existing customers and their associated recurring monthly revenue (RMR) for contracted services during a particular customer / calendar cycle - NET ATTRITION:

Gross attrition [adjusted for] the add back of “like customer” gains through re-signs of the existing locations –- The [premise] location as the ultimate customer

- Price increases for inflation

- Price increases for additional services or technology

For our purposes, suffice it to say, gross attrition includes all customer losses (every customer canceled or not paying). Net attrition recognizes offsets for new customers taking over existing systems, rate increases for inflation and the new RMR from additional services provided to existing customers.

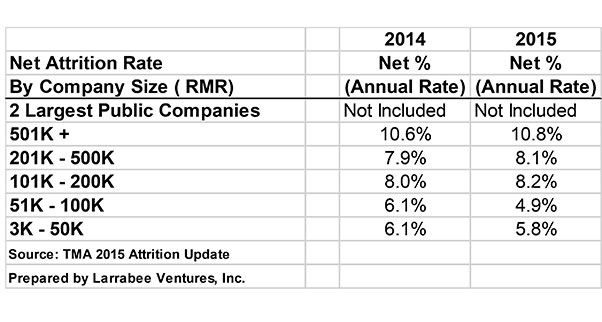

The industry average net attrition rates by company size are reported as follows:

Note that the attrition rates are lowest (best) for the smaller companies. We believe the smaller companies have better attrition rates because they have and maintain closer relationships with their customers. That’s a benefit of being small.

We do not, however, believe that larger companies need to have higher attrition rates just because they are larger. Rather, the larger companies need to do a much better job of developing and maintaining closer relationships with their customers. Much more on that in future posts.

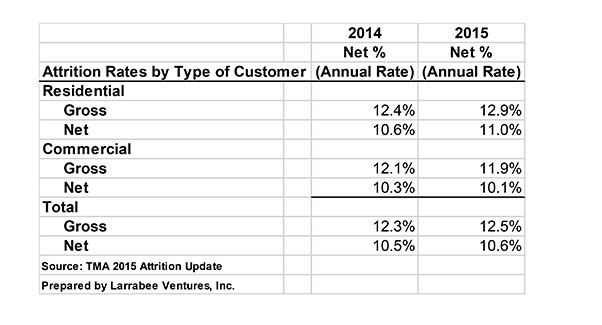

The TMA report also itemizes the gross and net attrition rates for residential and commercial customers as follows:

Note that residential attrition rates tend to be a half percent or so higher than commercial attrition rates.

For the purposes of these blog posts we will use an average of the TMA’s 2014 and 2015 residential and commercial rates, 12.4% for gross attrition and 10.5% for net attrition.

Lenders and Attrition

Lenders to the industry typically require regular monthly measurement and detailed reporting of attrition.

There are a variety of attrition definitions and measurement requirements in individual loan agreements. Attrition covenants typically specify a maximum acceptable attrition rate, and violation of the attrition covenant is an event of default which can result in severe consequences.

Why are lenders so concerned about attrition?

Lenders worry because the primary collateral for their loans is the recurring revenue produced by the customer accounts. They want to be sure it will not fade away before their loan is paid back.

Owners and Attrition

Unfortunately, many owners (borrowers) only seem to work hard to reduce attrition when they fear the attrition covenant in their loan agreement may be broken.

Shouldn’t owners be more concerned about attrition than their lenders? Of course they should.

One Simple Truth

The recurring revenue from every customer account that is canceled must be replaced or the company shrinks.

If there are too many leaks in your bucket the company will stall, become less profitable, have less cash flow and not grow as desired.

- How many leaks are you willing to have?

- How much is it worth to plug the leaks?

- Better yet, how much is it worth to prevent the leaks from occurring in the first place?

- Best, how much would it be worth to not just minimize attrition but, instead, turn your existing customers into a source of net growth in recurring revenue?

We believe current industry attrition rates, gross attrition averaging 12.4% and net attrition, at 10.5%, are sapping the industry’s strength.

These rates can be reduced substantially by embracing effective customer retention strategies.

Lower attrition will result in faster growth and financially more healthy companies.

Even if your company’s net attrition rate is lower than the industry average, say 1% or 2% lower than the average for its size, attrition is still higher than it could be. Even if your attrition rate is 5% or 6%, it can still be improved. Don’t become complacent just because your attrition rate is better than the industry average. There is always additional value in improvement of the attrition rate.

We believe that attrition rates for companies of any size can be improved and that every company should establish an attrition improvement target to reduce the current rate by 1.0% to 1.5% each and every year.

The problem is, the average company management is NOT paying enough attention to the huge cost-saving and profit-making opportunities that result from reducing attrition, improving customer retention and helping their existing customers to add more services and new features.

Many larger companies, especially those that are private equity financed, are all into growth, growth, growth.

Management teams are focused on building internal sales and growing via acquisitions; both are big, time consuming jobs. The finance guys want to maximize the recurring revenue margin.

Unfortunately, under these circumstances, attrition mitigation, customer retention and customer expansion often take a back seat and only become important when talking with lenders about obtaining more capital for growth.

We are going to show you how you can substantially reduce net attrition and substantially increase your company’s profitability and long term growth.

Think of the water in the bucket as the value of your business. What if all the holes could be patched?

The key takeaway from this post is:

Attrition is a substantial drain on the growth and vitality of security alarm companies.

The key takeaway from the future posts will be:

You can reduce or even eliminate net attrition (yes we said even eliminate) if you give it the priority and resources required.

You cannot afford to ignore attrition or take it lightly. Controlling your rate of customer loss is critical.

What do you think? Leave us a comment or ask a question. We will respond.

Resources used in this article:

Larrabee Ventures, Inc. (LVI)

LVI is staffed by highly experienced alarm professionals.

William Larrabee (“Bill”) has started three alarm companies from scratch, been president of five different alarm companies, and worked through crisis situations in numerous companies, either as an on-site executive or paid financial advisor. Bill knows the alarm business.

Michael Carter (“Mike”) has been a sales manager and vice president of sales and marketing for five of the largest alarm companies in the US. He also has ten years of experience driving sales and marketing programs as a consultant and coach. Michael knows sales, marketing, and sales management for alarm companies. For more information about LVI please visit our website: Larrabee Ventures.com.

Together we will answer your questions and help you get your business out of the fog and back on the open road.