In the first posts, “Is Saving Customers Important?” and “How Big A Problem Is Attrition?”, we discussed why reducing customer attrition is vital to a company’s health. Also we introduced The Monitoring Association’s Attrition Survey which shows security industry average net attrition rates of 10.5%.

Now let’s look more closely at how this affects you,

How much is attrition costing your company?

The short answer is a lot, probably much more than you think.

The longer answer is attrition has two very large costs, both of which impact and limit your company’s long-term value:

- Attrition costs a lot to replace.

- Attrition kills real net growth,

Let’s dig deeper:

Cost to Replace Attrition

To quickly determine how much attrition costs each month, you need to do a back of the envelope calculation involving two pieces of data:

A. Creation Multiple: Your Creation Investment per $1 of new RMR created, and

B. Net RMR attrition per month

To estimate your Creation Multiple do the following math for the last month:

Add:

- Total Selling expense

(including wages, commissions, lead costs, advertising, vehicle allowances and sales overhead), - Total Installation expense

(for new RMR installations, include installation wages, direct expenses and overhead) - Total Equipment expense

(for new RMR installations only) - Half of the G&A expenses.

Then Subtract:

- Installation Revenue received

(from the new RMR customers only).

The result is Creation Investment: the investment the company is making in creating new customers. Take this Creation Investment and divide it by the new RMR created.

The result is the Creation Multiple: the Creation Investment per $1 of RMR created.

Multiply the Net RMR Attrition last month by the Creation Multiple to get your full cost of replacing attrition last month.

Example 1:

A company has 1000 customers and the following typical industry parameters:

- RMR lost last month = 10 customers X $32 = $320

- Creation Multiple: Cost to replace each $1 of RMR = $1200 per new customer divided by $40 RMR per new customer = 30

- Monthly investment to replace attrition = a X b = $320 X 30 = $9,600.

If you currently have 1000 customers at $32 average RMR per customer and your annualized net attrition rate is the industry average of 10.5%, you probably are losing about 10 customers per month and spending around $9,600 per month to replace the RMR those customers produced.

Here’s the kicker:

In 10 years, 120 months, that’s $1,152,000 spent just to maintain the RMR of a 1000 accounts.

That’s a lot of money! Over a million dollars for each 1000 accounts.

If you have 5,000 or 10,000 accounts multiply this number by 5 or 10.

The long term cost is millions of dollars. For a company in the SDM 100, even near the bottom, it is tens of millions of dollars.

What could you do in 10 years with an extra $1 million, $5 million or more?

Additional Comments:

Consider these additional comments on the cost of replacing attrition:

You may think we are using attrition rates and Creation Multiples that are higher than the actual current results in the industry. To test this we looked for publicly available data to compare. Consider the following:

- ADT, in its last reports prior to being taken private in June 2016, reported for the quarter ended December 31, 2015:

- Subscriber Acquisition Cost Multiple (i.e. Creation Multiple): 30.5.

- Subscriber Acquisition Cost per new customer: $1,484.

- Net attrition rate (annualized): 12.2%.

- MONI, formerly known as Monitronics, reported its Creation Multiple as 35.6 and annual RMR attrition rate as 13.4% for the second quarter of 2017. Note that 26% of MONI’s account creation is internal, primarily DIY. In Q2-2017 MONI reported creation of 26,782 new accounts and $1,304,000 new RMR and still their total number of accounts and RMR shrank.

- A 2013 presentation to the SedonaOffice Users Conference used examples with Creation Multiples of 29.0 and reported from the Annual SedonaOffice Users Survey for 2012 that attrition rates averaged 10.7% and net RMR growth was 11.4%.

You may believe your Creation Multiple is much less than 30. If it is, great. That doesn’t change the fact that money is being spent to replace existing customers who cancel. Calculate what your attrition replacement costs are over the next 5 to 10 years. They are big!

Some Fire Alarm and System Integration companies price new jobs to earn not only a gross margin, but an actual profit on the initial installation. In these companies the Creation Multiple is zero or negative. For the purposes of evaluating the impact of attrition on the company’s future, a company with a zero or negative Creation Multiple should look at how much the growth rate is reduced by the need to replace canceling customers.

Smart people calculate the Creation Multiple in several different ways. Some do not include any sales or installation overhead or G&A expense in the calculation of Creation Investment. Ignoring overhead and G&A reduces the costs attributed to creating new accounts. This results in a lower Creation Multiple.

While calculating Creation Investment using only direct out-of-pocket costs is representative of the incremental cost of creating one more account, it is misleading as to the total resources required to create new customers and the Creation Investment which is destroyed by attrition. We include half of G&A in the Creation Investment because we know that account creation uses lots of G&A resources including management attention, raising capital, facilities, accounting, office staff and payroll.

Attrition is not a one-time occurrence. It is over and over every month and, for many companies, replacing attrition consumes half or more, sometimes all, of their Creation Investment in new RMR.

A substantial portion of this attrition can be mitigated by implementing sound customer retention strategies which we’ll discuss in later posts.

Attrition Kills Growth

Replacing attrition diverts a large portion of New Customer Creation from growing the company to just keeping it stable.Remember this picture?

The amount of water in the pail represents the size of your customer portfolio and the value of your company.

How much of the water being poured in (each month’s new customer creation) is actually adding to the level of the water in the pail?

How much is just leaking out through the attrition holes?

For many companies, especially the more mature ones, the positive results of the New Customer Creation activities are almost all destroyed by the need to replace attrition and New Customer Creation contributes little to real growth.

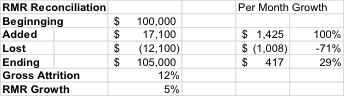

Example 2:

In the SedonaOffice User Conference cited above, Michael Barnes used the following example company to illustrate stable-business cash flow, an important industry metric.

His example:

A company with $100,000 in RMR, industry typical attrition rate of 12.1% and annual new RMR creation of $17,100.

Sounds good until we look at how much of the new RMR creation (71%) is diverted to replacing attrition. In this company almost 3 out of 4 newly created customers and associated RMR are diverted to replacing the lost RMR and only about 1 of 4 is real growth.

A robust new account creation program, producing over $1,400 per month in new RMR is dragged down to a slow net growth program producing only $417 RMR per month in net growth.A major loss from attrition is growth. Fast growth is replaced by modest growth or, in many cases, no growth.

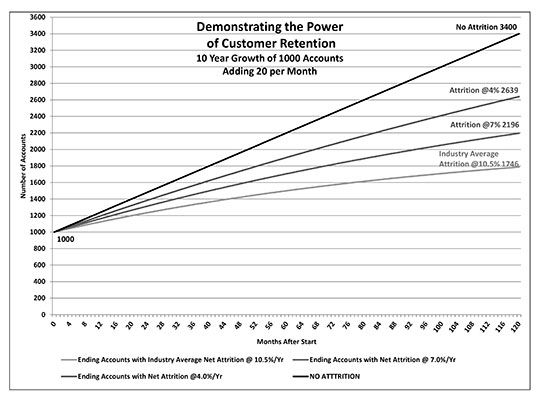

Example 3:

Here’s another example:

- Current account portfolio: 1000 accounts

- Growth: Creating 20 accounts per month

See the graph below which charts the growth of this company with various rates of net attrition.

In this example, with an industry average net attrition rate of 10.5%/year, over 10 years the company will add 2400 new accounts but only keep 787 (32.8%) as net growth. The rest of the accounts, 1613, will be devoured by attrition.

Lower attrition rates result in much more net growth.

Are you convinced yet that your attrition rate needs to be reduced?

Even if you have much lower attrition than the industry average you will benefit by making customer retention more of a priority in your company.

The key takeaways from this post are:

- How to quickly calculate the cost of replacing attrition.

- Industry average attrition rates result in spending over $1 million for each thousand accounts just to replace attrition over the next decade.

- Attrition kills growth.

The key takeaway from this attrition series will be:

- You can reduce or even eliminate net attrition (yes we said even eliminate) if you give it the priority and resources required.

LVI is focused on helping companies to reduce attrition, increase customer retention and increase new customer creation.

Larrabee Ventures, Inc. (LVI)

LVI is staffed by highly experienced alarm professionals.

William Larrabee (“Bill”) has started three alarm companies from scratch, been president of five different alarm companies, and worked through crisis situations in numerous companies, either as an on-site executive or paid financial advisor. Bill knows the alarm business.

Michael Carter (“Mike”) has been a sales manager and vice president of sales and marketing for five of the largest alarm companies in the US. He also has ten years of experience driving sales and marketing programs as a consultant and coach. Michael knows sales, marketing, and sales management for alarm companies. For more information about LVI please visit our website: Larrabee Ventures.com.

Together we will answer your questions and help you get your business out of the fog and back on the open road.