More than 30 years ago, when I was a young alarm company owner busy growing our business with new sales, I might have said; “Well we lose one monitored account, but the loss is partially offset by a reduction in our monitoring and billing costs and we might save a little in service as not all our service turns out to be billable. The loss of a $40 RMR customer is about $33 per month – that’s it, no big deal.” At that time, I thought there was an endless supply of new customers and I didn’t understand the value of recurring revenue.

Now, we say; “That’s all wrong, the company is growing and when it loses a customer the very next customer created (sold) has to fill up the RMR hole caused by the lost customer. The company is pretty efficient creating new customers so the out-of-pocket incremental costs, net of money received from the new customer, add up to only 20 times the RMR created. Then we add half of the unallocated G&A to the Creation Investment because the rent, utilities, telephone and management are all necessary to create new accounts.”

The company’s Creation Multiple is 30 or 32 times RMR (20 times for the variable costs plus an allocation of 50% of the G&A) and so the cost of losing the $40 RMR customer is $1,200 – $1,280 ($40 multiplied by 30 or 32). A lot of money, 2 and 1/2 years of revenue, 3 – 3 1/2 years of profit.

This whole discussion reminds me of one you might have if you had a fender bender and didn’t have insurance. How much does the fender-bender cost? The answer is; the fender bender itself costs nothing if you don’t fix it. It’s the cost of restoring the car back to its original pre-accident state that is costly. In the alarm company case, it’s the cost of restoring the company to its prior level of recurring revenue and profit that is relevant.

So What is the Replacement Cost of Recurring Revenue?

The loss of a $40 RMR customer costs out-of-pocket $1,200 -$1,280, or more.

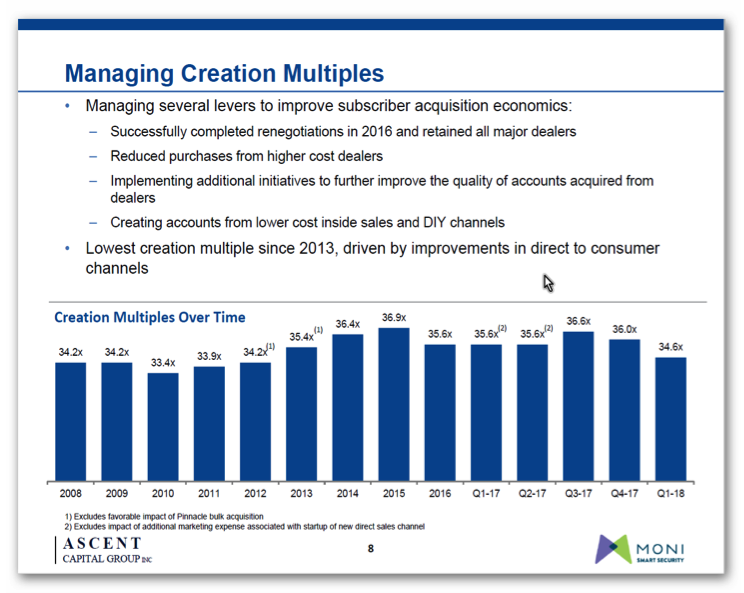

For a real current example, in our recent ebook, Monitronics Under The Microscope, MONI’s management lists their recent Creation Multiples as trending between 34.6 and 36+, see chart below:

The Point is, losing customers costs you dearly.

I keep being reminded; the value of a portfolio of customers is like the total amount of water stored in the pail. See our prior blog post; “Is Saving Customers Important?.”

When holes develop in the pail, water leaks out and there is less water left in the pail. When your sales department pours in a glass full of new customers, their hard work and Creation Investment is wasted to the extent the attrition leaks in the pail continue to drain the existing customers away.

If, on the other hand, you are going to keep the company indefinitely, the leaks in your pail are stunting your growth and stealing from your retirement and your estate.

What is it Worth to Save $40 in Recurring Monthly Revenue?

Let’s say the customer will renew his agreement and stay on if the company will upgrade his system at an out-of-pocket cost to the company of $800. Is that a good deal?

We would say yes because the alternative of replacing with a new customer is even more expensive.

Some of you will respond, “That’s extortion. We already paid for the customer once when we first sold it, why do we have to pay again?”

Well you don’t have to give in to extortion, but why would you want to give up the old customer? Isn’t it better to have both your existing customer and your new one?

Wouldn’t the best solution be to build a customer retention culture into every aspect of the company’s relationship with its customers? We’ll show you how in another blog post soon.

If attrition and customer retention aren’t in the front of your mind daily, your company is almost certainly losing a tremendous amount, perhaps even jeopardizing your company’s future health.

Larrabee Ventures, Inc. (LVI)

LVI is staffed by highly experienced alarm professionals.

William Larrabee (“Bill”) has started three alarm companies from scratch, been president of five different alarm companies, and worked through crisis situations in numerous companies, either as an on-site executive or paid financial advisor. Bill knows the alarm business.

Michael Carter (“Mike”) has been a sales manager and vice president of sales and marketing for five of the largest alarm companies in the US. He also has ten years of experience driving sales and marketing programs as a consultant and coach. Michael knows sales, marketing, and sales management for alarm companies. For more information about LVI please visit our website: Larrabee Ventures.com.

Together we will answer your questions and help you get your business out of the fog and back on the open road.